Grab: A Deep Dive

GRAB-ing Southeast Asia by the Wheel

Welcome to all of East Meets West’s newest subscribers!

Building off of our last issue on Gojek, today’s issue focuses on Gojek’s biggest competitor in Southeast Asia, Grab!

Grab is a Singapore-headquartered Southeast Asian SuperApp. The company is best known for its ride-hailing services throughout Southeast Asia (SEA) but also offers dozens of other services including payments, delivery services, and a suite of financial products.

The company was started in 2012 as a project at Harvard Business School. Grab is Southeast Asia’s most and the world’s 10th most highly valued private technology company. Grab was Southeast Asia’s first “decacorn” company and has grown to be the biggest mobile technology company in the region. It is valued at ~$14 billion.

Team

Anthony Tan (Co-Founder/CEO):

For Anthony Tan, Grab’s CEO and Co-Founder, transportation was in his blood. His great-grandfather was a taxi driver and his grandfather, Tan Yuet Foh, founded Tan Chong Motor (“TCM”), a ~$700 million public company in Malaysia. TCM is involved in automobile assembly, manufacturing, distribution, sales, and was the original franchisor (seller) of Nissan cars in Malaysia. Anthony’s father was the CEO and is now Board President of the company. Prior to Grab, Tan’s family was already one of Malaysia’s richest families.

Anthony attended the University of Chicago (’04) for his undergraduate degree in economics and public policy. He returned to the family company as ‘Head of Marketing’ before going on to Harvard Business School (’11) to complete his MBA.

Something that stood out about Anthony (at least compared to other technology leaders) is that Mr. Tan is a devout Christian. It comes across in his leadership style (covered in more detail later).

He was quoted saying,

“Grab is a secular business, but I’m driven by the biblical principles of love, generosity, humility and forgiveness. I fall short, of course, but those are the qualities I aspire to embody day in, day out,” he says, adding that Jesus Christ is one of his leadership heroes.

In addition to Jesus Christ, he counts Masayoshi Son as his mentor. (I wonder if this is where Masa got the inspiration for this quote from)

Tan Hooi Ling (Co-Founder/COO)

Ling (no relation to Anthony Tan) comes from a middle-class family in Malaysia. She attended the University of Bath in the UK earning a degree in mechanical engineering before going to work at McKinsey in Malaysia for three years. McKinsey then sponsored her MBA at Harvard Business School (HBS) where she met Anthony and co-founded Grab.

Interestingly, because McKinsey sponsored her MBA, she had to return to McKinsey after HBS. She stayed at McKinsey in San Francisco for 1 year (Jan. ’12 – Jan. ’13) before going on to Salesforce in San Francisco for 2 years (Feb ’13 – March ’15). She says in an interview that she took a 6-month leave from McKinsey to help launch Grab in Malaysia. Of Salesforce, she says “[for] financial and personal reasons, the latter of which she chooses not to elaborate on, Hooi Ling [went to Salesforce] in the San Francisco Bay Area.”

She returned to Grab full-time in 2015, assuming the role of COO. She is a noted introvert, a complement to Anthony’s extroverted personality.

Amount Raised and Investors/Board Members

Grab has raised $9.9 billion over many rounds of funding and from many investors.

The very first money into Grab was the award money from the HBS contest they won and some money from Anthony’s mother. Per a Fortune article, “Grab’s first venture investor was Anthony Tan’s mother, who confessed she didn’t understand his business model but hoped it would succeed because his father—who had already turned Anthony down—was threatening to disinherit him from the family’s considerable fortune”

Subsequently, Grab’s earliest institutional investors include Vertex Ventures (a wholly-owned subsidiary of Temasek) and GGV Capital. Later investors include Tiger Global, Softbank Vision Fund, Toyota, MUFG, DiDi Chuxing, China Investment Corporation, Honda, Booking Holdings, and many more.

Notable Grab Board Members Include:

Andy Mills: Andy is the former CEO of Thomson Financial. He met Anthony Tan at a Christian Fellowship that Anthony attended when Andy was speaking. Andy is an active Christian and in Anthony’s words “[Andy] is to some extent not only responsible for my spiritual growth but for the growth of GrabTaxi too”

Dara Khosrowshahi: Dara is the CEO of Uber and joined Grab’s board after Uber took a 27.5% stake in Grab (spoiler!).

History

When Anthony Tan was at Harvard, he saw the success that Uber was beginning to have in the US and was thinking about how he could bring that to Malaysia. Sound familiar? Anthony and Nadiem, founder of Gojek (covered in the last issue) met while doing their MBAs at HBS.

Anthony, working with his co-founder, Tan Hooi Ling (and a third student, Adeline Chan who seems to have had no formal involvement with Grab post-HBS), founded Grab while at Harvard as part of a business plan competition. The idea (originally named MyTeksi) was the runner-up winner in the HBS New Venture Competition in 2011.

From the beginning, the idea was for a mobile app to match taxi drivers and riders (compare this to Gojek which started as a call center to match ojeks and riders).

Anthony and Hooi Ling (who goes by “Ling”) both grew up in Malaysia and knew the problems of the taxi industry firsthand. Ling has said that Malaysia historically has had some of the world’s worst taxi services ranging from drivers who refuse to use the meter to outright rude and aggressive behavior.

The app launched in Malaysia in 2012. Its core value prop was being a “taxi-dispatch service with GPS-enhancements, allowing passengers to hail the nearest taxi with extreme ease.” This was an improvement for drivers who spent less time idly cruising for passengers.

Besides figuring out the intricacies of ride-hailing, one of the big hurdles that Grab seems to have solved was that not all drivers would have a smartphone.

From their original HBS plans for MyTeksi:

“The drivers would be supplied with smartphones so they could communicate directly with prospective customers, thus saving valuable time and money wasted in driving endlessly seeking fares […] Unlike Uber, which has upset local taxi markets by launching a competitive force to cab drivers, GrabTaxi is working with taxi drivers to help them do better business.”

Grab bought smartphones in bulk and gave them to drivers who paid off the phones with daily installments.

It was also a huge improvement for riders who felt much safer with Grab. “Grab lets riders retrieve drivers’ police records through the app and share routes and license plate numbers with friends and family. The app also masks passengers’ phone numbers on the driver’s end as an additional safety precaution.”

As of June 2014, Grab was available in Singapore, Malaysia, Thailand, Vietnam, Indonesia, and the Philippines and had 250,000 active users and more than 25,000 drivers. Around this time they also expanded their offering by adding GrabCar (where anyone with a car, not only taxis, could drive) along with GrabBike (similar to Gojek’s core offering).

From launch through early 2015, all Grab payments were done using cash. This put the impetus on drivers to have to pay Grab for each ride that they delivered on. It seems like this is worked by drivers keeping a tab of sorts with Grab that they’d have to pay off after some period of time. Even though payment wasn’t happening in the app early on, ride amounts were still tracked there.

In 2016, Grab rebranded MyTeksi in Malaysia to also be under the Grab umbrella, centralizing its branding across Southeast Asia. This stands in contrast to Gojek’s approach of using local branding in each new market.

In the background, Uber continued to be the elephant in the room. Uber was spending money to expand through the world, with a strong focus on Asia. Uber entered key markets like Singapore in 2013, Vietnam in 2014, and by 2016 was in 15 cities across Singapore, Indonesia, Malaysia, Thailand, Vietnam, and the Philippines. I believe what allowed Grab, Gojek, Didi, etc. to prevail in their regions is that they had a better local understanding. Uber tried to launch UberMoto (motorcycle hailing) but they did not have the same local understanding of these markets that the homegrown companies did. When Uber entered these markets, they went by car first and then motorcycle later. Companies like Grab did the opposite, taxi, motorcycle, then car (because that’s what consumers were more familiar with). Anthony was quoted as saying

“Grab prevailed over Uber, Anthony argues, because it adapted to local consumers’ needs. In a relatively low-income region, Grab provided a platform for cheap taxis and motorcycles to counter Uber’s expensive “black cars.”

Each of these countries has smaller, homegrown options as well. For example, the Philippines have 10+ ride-hailing startups. In most of these markets though, it was Uber vs. Grab (and later on, vs Gojek too).

By 2018, Uber had a new CEO at the helm and was looking to stop “[taking] on too many battles across too many fronts and with too many competitors.” Uber agreed to combine their SEA business with Grab in exchange for a 27.5% equity stake in Grab that would convert to $2 billion in cash if Grab doesn’t go public by 2023. Uber CEO, Dara Khosrowshahi also took a board seat at Grab. The two companies were later fined $9.5 million (arguably pennies considering the deal size) by Singaporean regulators over an “anti-competitive deal”.

After acquiring Uber’s SEA operations, Grab embarked on the journey of becoming a Super App (“One app for multiple services” in Grab’s words). They wanted to become a platform company composed of technology, people, and operational “on the ground” infrastructure.

They defined their strategy as:

“Partners can expand more efficiently across Southeast Asia by leveraging Grab’s user base and Southeast Asia’s largest distribution channels through GrabPlatform, a suite of APIs that enables partners to access components of Grab’s technology like logistics and payments.”

By this point in 2018, Grab had secured more than 100 million downloads of its app and crossed 2 billion rides across all markets. This is when they brought on their first platform partner, grocery delivery service, HappyFresh (the Instacart of SEA).

In 2018, Grab surpassed $1 billion in revenue and with the integration of Uber’s SEA operations, it was expected to do $2 billion in 2019.

By October of 2019, Grab was operating in 339 cities across 8 SEA countries. The Grab app had been downloaded over 166 million times and had over 9 million drivers and merchants on the platform.

Product

Similar to Gojek, when you open the Grab app, there are a lot of services fighting for your attention. To use the comparison to an operating system, if you look at the bottom dock of the Grab app, the features that sit there are activity history, payments, chat, and settings -- showing the focus they have on payments and the newer chat feature. Chat seems like an awkward feature to have in an app focused on services, but WeChat’s success in building a product in the opposite direction (chat first then paid services) seems to make other SuperApps feel the need to tack the feature on eventually.

Grab has relied on partnerships and their third-party app platform to build out a lot of their services. They have many common services such as transportation (everything from cars to geographically unique options such as a ‘Thone Bane’ in Myanmar), good delivery, parcel delivery, and grocery delivery.

Some more unique offerings they have:

GrabHealth - A telemedicine service for e-consultations and medicine delivery via partnership with Ping An Health

Grab Entertainment - A way to buy movie tickets

Grab Subscriptions - Ways to buy ‘coupon books’ to restaurants and different plans for frequent riders

Grab for Business - Portal for companies to manage rides for their employees. Interesting because if they add other services like travel booking, insurance, and direct payroll through Grab Wallet, this becomes like JustWorks + Trip Actions + Uber + Bank account.

Grab Ads - For companies to buy car wrapping, in-car advertisements, in-car product sampling space, in-car screen displays, sponsored in-app communications, and more…

Grab Video (discontinued) - A streaming service in partnership with Hooq, but Hooq went bankrupt

They have a large offering of financial products via Grab Financial and have invested a lot in building out these services. Grab is in the process of applying for its Singaporean digital banking license in a joint venture with Singtel, Singapore’s largest telecom provider.

In February of 2020, Grab raised $856 million mostly from MUFG (Japan’s largest bank by AUM) specifically to expand its financial offerings. They plan to offer lending, insurance and wealth management products and services for Southeast Asian consumers and small and medium-sized enterprises.

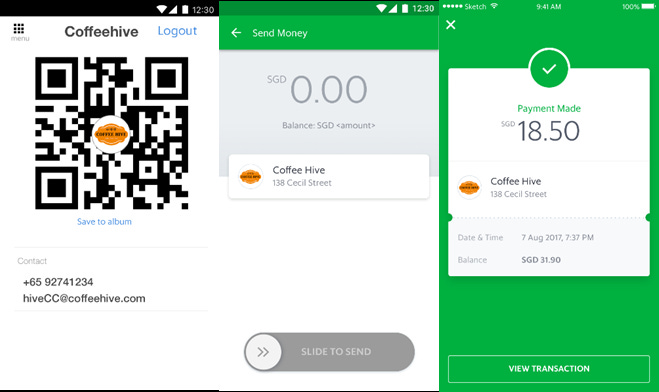

Their core financial product, GrabPay, was launched in January of 2016. GrabPay is Grab’s mobile wallet solution to help “bank” the populations they operate in.

Through GrabPay you can link your debit or credit card, top up your e-wallet with direct bank connections, use Grab services like transport or food, send funds to other people, and make in-person payments.

In November of 2017, they made a big jump by rolling out GrabPay for third-party merchants. Similar to Chinese payment companies, GrabPay users became able to pay for in-person purchases with QR codes.

One of the most important features Grab offers to its GrabPay users is an easy way to move money in and out of the financial system. In markets like Indonesia (where Grab is partnered with OVO to offer GrabPay), users can top up their accounts with cash via their driver for no fees! This option is cheaper than ATM/bank transfers.

“If people have cash in a system and can’t get it out, they want to get it out,” Thompson said. “If they have cash in a system and know they are able to get it out, that makes them relax, and they actually leave more money in the system. Our customers leave a lot in our wallet because they’re confident that they can get it out when they need it.”

GrabPay operates natively in Singapore, Malaysia, and the Philippines. In Indonesia, Grab is partnered with the local e-money platform, OVO. In Vietnam, Grab is partnered with a local solution, Moca. In Thailand, Grab has announced but not yet launched its partnership with Kasikorn Bank.

They offer additional services including:

GrabRewards - Similar to credit card rewards points. Highest tiers even get common credit card perks like preferential airport lounge rates

GrabGifts - Ways to send Grab gift cards to other users

Grab Finance for Drivers -

Upfront Cash - where drivers could take out a loan against their future earnings

Shop Now, Pay Later for Smartphones - part of their initial value prop for drivers to get a smartphone

Grab Finance for Merchants offers business loans and lines of credit to SME merchants

Grab Insure - a suite of “microinsurance” options for its drivers, merchants, and riders, appealing to SEA lower-income individuals. Some of their plans are pennies per day. Some of Grab’s markets -- specifically Indonesia -- are some of the least insured populations in the world.

Gojek and Grab have taken different approaches to rolling out new offerings and to Gojek’s credit, they have WAY more offerings than Grab does.

Grab has made fewer acquisitions (3) than Gojek (12) and chooses to partner with other companies to offer many of its new services whereas Gojek builds or brings (via acquisition) more services in-house. Only in April of 2019, did Gojek introduce their third-party platform.

From Aditi Sharma, Grab’s Director and Head of Startup Programs & Investments:

“It is clear from the beginning that doing this all by ourselves is not entirely practical. Strategically it makes more sense for us to build a healthy ecosystem of partners around our users. “Hence we are constantly seeking quality partners in the ecosystem to work with on our everyday superapp vision,”

High-level, Grab has done international expansion better than Gojek. And it does seem like Grab is fast-following Gojek on its ambitions to become a SuperApp. Nadiem (Gojek co-founder) was quoted saying,

“It’s really interesting that Grab has started to try to take that word away from us. I’m like, ‘Excuse me?’ You spend the first years of your life copying Uber? And then the next three years of your life copying Go-Jek?”

For a granular look at Grab’s product offerings follow this link to my additional write-up on the topic.

Competitors

Per App Annie’s data reported in the Financial Times, Gojek is beating Grab in Gojek’s home market of Indonesia (which makes sense since Gojek has focused most of their efforts on Indonesia). Grab is winning in every other Southeast Asian market.

I believe Gojek recognizes this, and it is the core reason why they have been quicker at rolling out additional services within their app (Gojek: “If we’re going to lose on geographies, maybe we can win on services”).

While Grab and Gojek have a lot of overlapping services (transport, insurance, food, groceries) Gojek has more of a long tail of services (most of the GoLife offerings like massages and home cleaning are unique to Gojek).

Each company has raised a ton of money from a great set of institutional and strategic investors.

Overall, “Gojek operates in 207 cities across four countries in Southeast Asia, 203 of which are in Indonesia. Grab is present in 339 cities across eight countries, and the majority, 224, are also in Indonesia.”

I would be remiss to look at the competition for Grab without talking about Uber and Lyft.

Lyft

In 2015-2016, Lyft was partnering with Asian ridesharing companies to create (what the media called) an “anti-Uber alliance”. Lyft partnered with Ola (India), Grab (SEA), and Didi (China) to offer Lyft users traveling abroad the ability to book rides in India, SEA, and China using Ola, Grab, and Didi’s services directly through the Lyft app (and vice versa).

The partnerships with Didi and Grab were called off after Uber left China and SEA and took ownership of stakes in Didi and Grab.

Uber

Doing all this work on Gojek and Grab gives me an incredible respect for Travis Kalanick’s call to expand rapidly into all of these global markets and then also gives me great respect for Dara Khosrowshahi’s call to exit all these markets via buying large stakes in competitors.

Uber stock is basically an index of all global ride-hailing companies (27.5% of SEA via Grab, 37% of Russia via Yandex, 18.8% of China via DiDi, 100% of the middle east via Careem, indirect ownership of Brazil via 99app.com, which DiDi owns). One article describes Uber’s actions perfectly, saying

“Uber seemed to invest just enough to prevent rivals like Grab from tipping the market to their platform […] Uber’s response was reasonable – it invested just enough to prevent these well-funded local players from tipping its markets. By doing so, Uber maximized the value of its business with the minimum investment. When consolidation came, Uber was able to secure a large percentage of Grab’s equity – reportedly 27.5%– in exchange for exiting the market. Arguably, Uber learnt the lesson in China, where it exited the market with 17.7 percent of Didi’s business. Thus, Uber will benefit from the Asian ride-sharing market growth long into the future.”

Acquisitions and Investments

Grab Ventures is Grab’s incubator, accelerator, and investment vehicle.

On the incubator side, within Grab Ventures, they’ve incubated: GrabFresh, GrabKitchen, and GrabWheels. Each seems to be structured differently.

GrabWheels, is the mobility arm of Grab, focused on developing two-wheeler electric vehicles (EV) solutions (scooters). The unit has its own CEO, Tj Tham, who moved into the role in November, 2018 after spending 5.5 years at other functions within Grab. GrabWheels raised $30 million in outside capital from Kwang Yang Motor Co, a Taiwanese EV leader.

GrabKitchen is Grab’s CloudKitchen division. As of Jan., 2020, they had about 50 cloud kitchens across 4 SEA countries and just launched their first in Singapore with 10 restaurants. It doesn’t appear this division has its own CEO (like GrabWheels). Right now, it seems like they invite merchants to set up stalls in a food court-like atmosphere. While there are dine-in options, most business comes from delivery options.

GrabFresh is a partnership with HappyFresh (the Instacart of SEA). HappyFresh went through some ups and downs since launch in 2015, having to pull out of some markets and bring in a new CEO. In 2019, HappyFresh raised a Series C with Grab Ventures participating. HappyFresh was also Grab’s first third-party platform partner. The Grab website calls the offering “GrabFresh (Powered by HappyFresh).

On the accelerator side, they’ve put 15 companies through the program to date and do 2 batches per year. Going through the accelerator does not guarantee investment or a commercial partnership with Grab.

Some of these include:

Tamasia: Gold buying and selling

My Cash Online: online store for migrants

Pergiumroh: Digitized “umroh” an Islam pilgrimage to mecca

Porter: logistics company

And many more…

To-date Grab has made 3 public acquisitions

Kudo: Kudo was a multi-part strategic acquisition for Grab. Grab wanted to expand their GrabPay offering into Indonesia.

Kudo operates IRL kiosks throughout Indonesia helping people without bank accounts or internet access buy online goods. Grab turned them into “GrabKios” and added some offerings including package delivery (via a company they accelerated called “Porter”), gold buying (via a company they accelerated called “Tamasia”), and microinsurance.

Grab ran into foreign ownership problems when they tried to expand their digital wallet in Indonesia. The acquisition of Kudo helped them to circumvent these restrictions.

iKaaz: In Grab’s quest to become SEA’s “universal payments platform”, it acquired Bangalore-based iKaaz. Per a Grab PR, “Ikaaz’s technology stack encompasses a range of innovations, such as NFC, QR-code, audio-based payments as well as bill payments, online payments, and P2P. This flexibility and scalability make it ideally suited for Southeast Asia’s diverse payments landscape and large unbanked population.”

Bento: This acquisition serves as the starting point for what will become GrabInvest. GrabInvest aims to democratize access to retail wealth management products, in order to provide millions across Southeast Asia with the opportunity to save and invest in financial products traditionally limited to affluent individuals and institutional investors.

Youche: Not much information on this one, other than a mention in a TC article. Apparently Grab bought this small Chinese ride-hailing company in 2013 to form it’s Beijing office.

When Grab raised billions of dollars in 2019, they said they were planning to use that to make ~6 acquisitions, but since that fundraise, they have only made 1 public acquisition of Bento (2020).

Grab is notably less acquisitive than its competitor Gojek. As a result, Grab has a smaller product/service offering than Gojek (which built most of its services out via acquisition). Grab also seems to be pushing their third-party platform more than Gojek, in an effort to partner with other companies rather than buy them.

Commentary

Know-your-customer isn’t just a Compliance Standard

For a lot of companies looking at Southeast Asia today, I think they envision the same kind of opportunities that an entrepreneur looking at China 10 or 20 years ago would have seen. A country (countries) with growing wealth, coming online quickly via smartphones, and a nascent payment landscape.

The Southeast Asia opportunity gets grouped into one but is actually 10 countries with deep cultural differences throughout (many languages, many islands, etc.).

Each requires boots on the ground knowledge and unique infrastructure.

Though they do have shared problems around safety, infrastructure, and shared “Asian cultures” and values, each new SEA country that one of these companies enters, requires real local knowledge.

From a Fortune article:

Just after Uber’s [ice cream event], Grab offered what Malaysians really scream for: smelly durians. Customers in Kuala Lumpur, the capital, could have one of the pungent fruits rushed to their doorstep by a Grab driver. To deliver on that promise, Grab had to devise special packaging: Durians, though considered a great delicacy, emit an odor so overpowering that they are banned in many airports and hotels. Grab surmounted that obstacle and offered the fruits at the bargain price of a single ringgit (24¢). They sold out almost immediately, and the “GrabDurian” marketing coup is now well into its fourth year.

Uber’s flaw -- and Grab’s success -- in Southeast Asia was largely defined by Uber’s decision to keep its offering the same across the globe. Grab offered users a familiar service that fits with their existing needs and wants, whereas Uber tried to push what worked in the west onto users in the east.

Know-your-customer isn’t just a compliance standard. It is a fundamental tenet of good business.

The Expansion Race in Southeast Asia

Grab currently operates in:

Malaysia (as of June 2012)

The Philippines (as of July 2013)

Singapore (as of October 2013)

Thailand (as of October 2013)

Indonesia (as of June 2014),

Vietnam (as of February 2014)

Myanmar (as of March 2017).

Cambodia (as of December 2017)

Comparing launch dates in new markets for Grab and Gojek, Grab comes out ahead in all markets. Even in Gojek’s native Indonesia, where Gojek launched as an ojek call center in 2010, Grab beat them to market with a mobile app in Indonesia.

This puts Gojek’s 2015 move very clear to me. From my Gojek post:

When Gojek launched their app in 2015, they had drawn inspiration from Uber and Lyft, but made the conscious effort to launch with more than just ridesharing. They did not believe ridesharing alone could create a strong enough network effect for the business. They launched with motorbike ridesharing, delivery (Go-Food), and shopping (Go-Send). My sense of what was going on in the background here was that Gojek’s main competitor, Grab launched in 2012 and by 2014, was beginning to expand ridesharing into Indonesia. Gojek did not want to lose their home market and wanted to give users multiple reasons to use their app so they launched with several applications for users whereas, at this point, Grab was only ridesharing.

Launch dates in SEA countries:

In Indonesia, Grab is competing against native Gojek. To show how much they want to win Indonesia, in 2019, Grab committed to investing $2 billion into its Indonesia expansion. This is on top of $1 billion that Grab is said to have already invested into Indonesia. To make this expansion, they have the support of their investor and kingmaker, Masayoshi Son, who said, “Indonesia’s technology sector has huge potential. I’m very happy to be investing US$2 billion into the future of Indonesia through Grab.”

In Indonesia, both Gojek and Grab use green as their uniform color, which can be confusing.

The Straussian Reading of Business and Product

One thing I took away while re-reading my post was that so much of launching a successful product is deciphering what it is that people really want. Borrowing an ELI5 definition of “Straussian” the teams refers to a situation where “there's a hidden meaning in the text, that you may need some background information on the author and subject to understand it.” This relates to my earlier points on “KYC a core tenet of business” and the value of localism, but let’s take it a step further. The users often don’t tell you what they want directly, sometimes you need to infer.

I listened to a podcast recently with the most-engaging Rory Sutherland where he said something to the effect of, “Most people think they own a dishwasher to clean dishes. But perhaps the greatest value you get from owning a dishwasher is that it gives you somewhere to keep dirty dishes out of sight.”

The same could be said of many of Grab’s products:

Grab founders realized that what the driver’s really needed for this to work was smartphones. Rather than Gojek who dealt with existing infrastructure and operated as a call center for years, Grab got to the root of the problem and gave all drivers a smartphone.

Reading about taxis in Malaysia, it actually sounds like they had always been pretty prevalent and relatively easy to hail, BUT they were very unsafe. Grab’s initial feature set focused on safety (license plate tracking, location tracking, etc.). At first (MyTeksi) Grab was solving for the problem of safety more than they were the actual “hailing” of a ride.

Then the quote I used earlier about GrabPay,

“If people have cash in a system and can’t get it out, they want to get it out,” Thompson said. “If they have cash in a system and know they are able to get it out, that makes them relax, and they actually leave more money in the system. Our customers leave a lot in our wallet because they’re confident that they can get it out when they need it.”

Grab realized that many people weren’t asking for digital payments, but they would be very happy with an easier and cheaper way to move in and out of cash (the thing they actually wanted).

This serves me as a reminder that yes, it’s good to interview and talk to your customers, but it’s also important to understand their comments in the context of the larger environment. To watch their actions and see if they line up with the behaviors you would expect given their comments and if not, deeply investigate the source of the dissonance.

Cool Random Stuff

One of my favorite stories I read about while writing this article was about when Anthony Tan went to the Philippines to meet with a taxi fleet boss.

Midway through the negotiations, there was a loud thud. [Anthony] peered under their table and saw what looked like a machine gun on the floor.

“I was like, holy cow, I guess this negotiation is going in your favour!” It was only later that Tan realised he had just sat across the table from one of the area’s biggest arms dealers.

Business overseas is a lot different than business in America!!

And to wrap this post up, a fun TikTok comparing Grab and Gojek: