Aspiring Super App Series #1: WhatsApp + Facebook

A mini-series covering the Super App ambitions of the American tech giants. This issue will focus on Facebook’s properties (WhatsApp, Facebook App, Instagram).

Housekeeping:

Welcome to all of the new East Meets West subscribers! Please email me with questions, suggestions, and feedback, especially if there are specific topics or trends you want me to write about.

For shorter takes, you can find me on Twitter @ryanrodenbaugh

This post started getting long, so I’ll break it up into a mini-series covering the Super App ambitions of the American tech giants. This issue will focus on Facebook’s properties (WhatsApp, Facebook App, Instagram).

If you haven’t read my last issue “How to Build a Super App” I recommend starting there. I covered defining characteristics of Super Apps, why they don’t exist in western countries, and how that might change.

On to the issue!

Introduction

In my last article, I made the claim that it is unlikely we will see a true SuperApp emerge in the west, and in general, I stand by that claim in this article.

One theme that emerged in researching the Super App ambitions of the American tech giants is that many of them seem to be fighting to become the Super App for other countries, particularly India. Amazon, Facebook, and Google all have active Super App-like products in India and other ‘emerging markets’ (e.g., Brazil)

This article will focus a lot on WhatsApp and other Facebook attempts at building Super Apps.

“The Facebook Company”

The company that has the most public ambitions to become a Super App is The Facebook Company (yes, that’s what it calls itself now) along with many of its subsidiary properties.

On the https://about.fb.com/ page, The Facebook Company breaks out their technologies/products as:

Facebook app

Messenger

Instagram

WhatsApp

Oculus

Workplace

Portal

Novi

Absent from that list is “F2 (Facebook Financial)”, which is now lead by David Marcus, the former PayPal CEO, former Head of Facebook Messenger, and co-creator of Libra.

If Facebook wants any of its apps to become true Super Apps, it must have payments as a core piece of infrastructure. Appointing a seasoned payment exec (David Marcus) and making payments into a company-wide initiative (i.e., F2 underpins fb.com, WhatsApp, Instagram, etc.) allows Facebook to have a powerful and unified payments experience across all of their applications.

(It’s also fun to think about F2 becoming an AWS-like product where Facebook builds a powerful payment infrastructure for themselves that they can then sell to other companies. If Libra does become a thing, it actually sets Facebook up as a large global payments infrastructure provider.)

The Facebook Company has a few core properties that are primed to be Super Apps.

In order:

WhatsApp

Messenger

Facebook.com

Instagram

Before diving into each of The Facebook Company products, I want to share a staggering statistic from Messengerpeople.com (yes, there is a niche publication for everything):

“There are only 25 countries in the world where WhatsApp is not the market leader [messaging app]. WhatsApp and Facebook Messenger are growing about twice as fast as Facebook, the original platform (+30% YoY). Currently, WhatsApp has the highest distribution of all messaging apps worldwide. If you combine all the existing apps of the Facebook Universe, there are only 10 countries in the world where the messenger market leader is not from the Facebook dynasty.”

WhatsApp

When Facebook bought WhatsApp for $19 billion, many were shocked, but Facebook knew exactly what they were doing.

As Bloomberg revealed:

“In early 2014, Tencent was interested in buying the messaging service WhatsApp. An acquisition would have shocked the world and given Tencent immediate global reach. But as they neared the final stages of an agreement, [Pony Ma, Tencent’s Co-founder/CEO], who took an interest in the deal, had to undergo back surgery, which delayed a visit to Silicon Valley to negotiate with founder Jan Koum. Mark Zuckerberg then swooped in and acquired WhatsApp for $19 billion, more than twice what Tencent had considered paying.”

It’s possible that the deal would not have happened, but WhatsApp would have been the perfect acquisition for Tencent. As WeChat struggled to expand globally, WhatsApp would have been the unlock for Tencent’s ambitions outside of China.

With one big exception (privacy) WhatsApp and WeChat also had similar product philosophies. Their founders cared much more about providing excellent experiences for their users while not being concerned about monetization. They both never wanted to ruin users’ experiences on the apps by overwhelming them with advertisements.

Tencent would have been able to bring the SuperApp playbook to WhatsApp and could have sped up their process of becoming a SuperApp in some markets like India (where WeChat made a big push but failed).

As of February 2020, WhatsApp has more than 2 billion users globally and supports more than 50 million WhatsApp business app users. There is no app more primed to become a SuperApp than WhatsApp.

As an American using WhatsApp, I had always thought of it as a glorified texting app with a “statuses” feature that no one uses. In markets like India and Brazil, WhatsApp already has much more SuperApp-like functionality and is an integral part of national culture.

WhatsApp’s biggest market is in India where, as of July 2019, it had 400 million monthly active users (~30% of the population). Those 400 million users represent about 70% of India’s 560M internet users.

While WhatsApp has more global users than WeChat (2 billion for WhatsApp vs 1.2 billion for WeChat), it does not have the same stronghold on one country like WeChat does on China, though the Indian market seems to be its targeted stronghold.

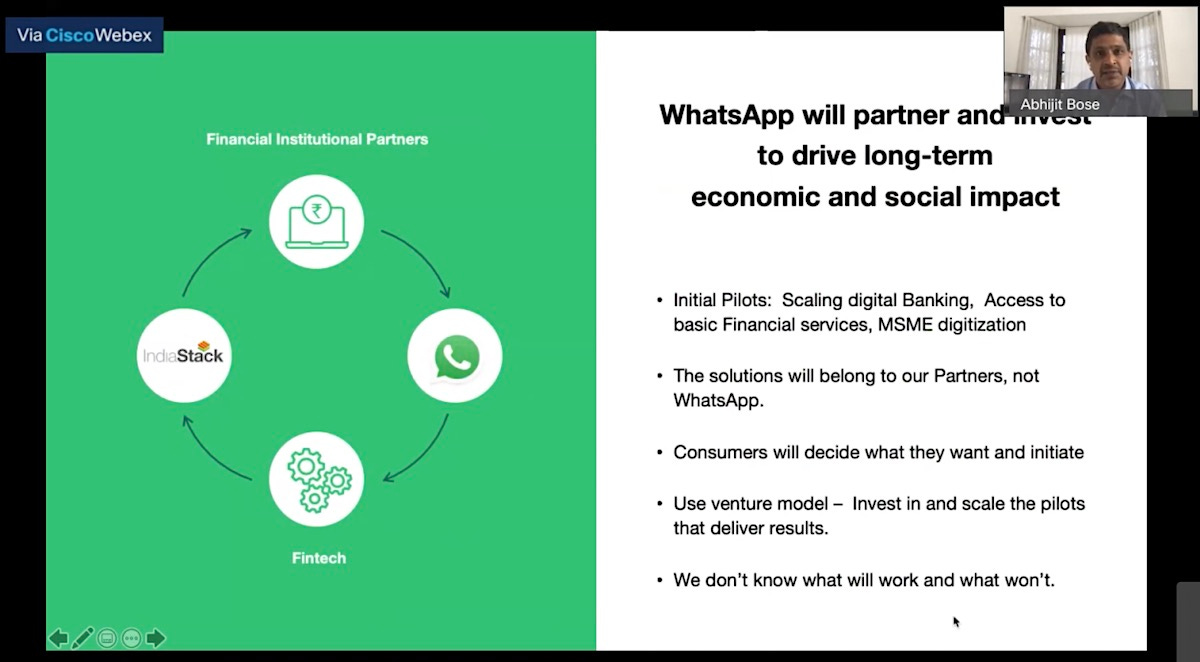

As far back as 2018, WhatsApp had a peer-to-peer payment functionality within WhatsApp for Indian users. Today, WhatsApp is running many financial pilots in India including “offer credit, insurance, and pension products to lower-income individuals and those in rural areas in India and help to digitize local small and medium-sized businesses.”

(Source)

WhatsApp also offers WhatsApp Business which reminds me of WeChat’s mini-program precursor, “Official Accounts”, which in 2015:

“WeChat also began partnering with physical businesses to offer online store functionality where in-person businesses could set up a digital storefront and sell goods. Their first pilot was with a Chinese department store. They also tried something with McDonald's where you could buy a coupon voucher within WeChat and then show the QR code to your McDonalds Cashier to redeem the offer.”

WhatsApp Business launched in January 2018 and by January 2019 had 5M businesses using it. One example cited in that blog post says,

“For example, in India, Bengaluru-based eyewear brand Glassic has told us that 30 percent of its new sales are generated through WhatsApp Business.”

By July of 2020, WhatsApp said the number of businesses using it had grown 10x to 50M businesses with 15M of those users in India. They also announced a business push to allow users to scan QR codes to interact with businesses along with allowing businesses to display catalogs of their inventory on WhatsApp (and making that sharable to other FB-owned platforms like Facebook.com and Instagram).

In absolute numbers, India is the world’s second most unbanked country (with 191 million adults without a bank account). As a percentage of its total population, that’s only about 11% though, which is not too high. The growth in banked % of the population is in part due to drastic measures from the government to decrease the country’s reliance on cash (via the controversial process of demonetization).

Notably, WhatsApp’s Head of India, Abhijit Bose was previously the CEO/Co-Founder of Ezetap, a mobile payments company in Bangalore. Earlier in his career, Abhijit was VP at a company building India’s (“Mall on the mobile”). Lots of SuperApp ‘easter eggs’ in his bio.

Facebook also invested $5.7 billion into India’s Jio Platforms, the digital services and telecom subsidiary of Reliance Industries, India’s largest company.

Prior to WhatsApp taking off in India, Jio had their own Super App ambitions:

“[Jio is] also said he had early ambitions to create a superapp in India akin to China’s WeChat, which lets users communicate, consume social media and entertainment, and pay for goods and services without leaving the app. JioChat, for example, offered the ability to book rail and bus tickets, but the app never took off.”

Facebook owes a debt of gratitude to Jio as many of Facebook’s India-based users are able to access Facebook and WhatsApp because of the wireless network that Jio has built.

The two companies are now working to collaborate on new offerings. I’m sure we will see Jio begin to sell items via stores built on top of WhatsApp.

From The Information:

“For example, Jio and Facebook have announced a commercial agreement to allow consumers to shop for items at JioMarts within WhatsApp and pay for items with WhatsApp Pay. Both companies have said this agreement is independent of their investment relationship.”

In Brazil, WhatsApp is also very active in running pilots to build out their payment offerings, likely with bigger ambitions of building a SuperApp for the country. WhatsApp is “present in 99% of all smartphones in the country, according to the study into messaging in Brazil.” 🤯

In many ways, the story of WhatsApp is one of breaking the monopoly of exploitative telecom networks that were overcharging users for SMS. Per HBR:

“The cost of SMS in [Brazil] was as much as 55 times more than in North America and far too expensive for most residents. So when the messaging service WhatsApp entered the market, in 2009, allowing users to send messages to anyone for free and regardless of their mobile carrier, people gravitated toward the platform. [In 2016], 96% of Brazilians with access to a smartphone use WhatsApp as their primary method of communication.”

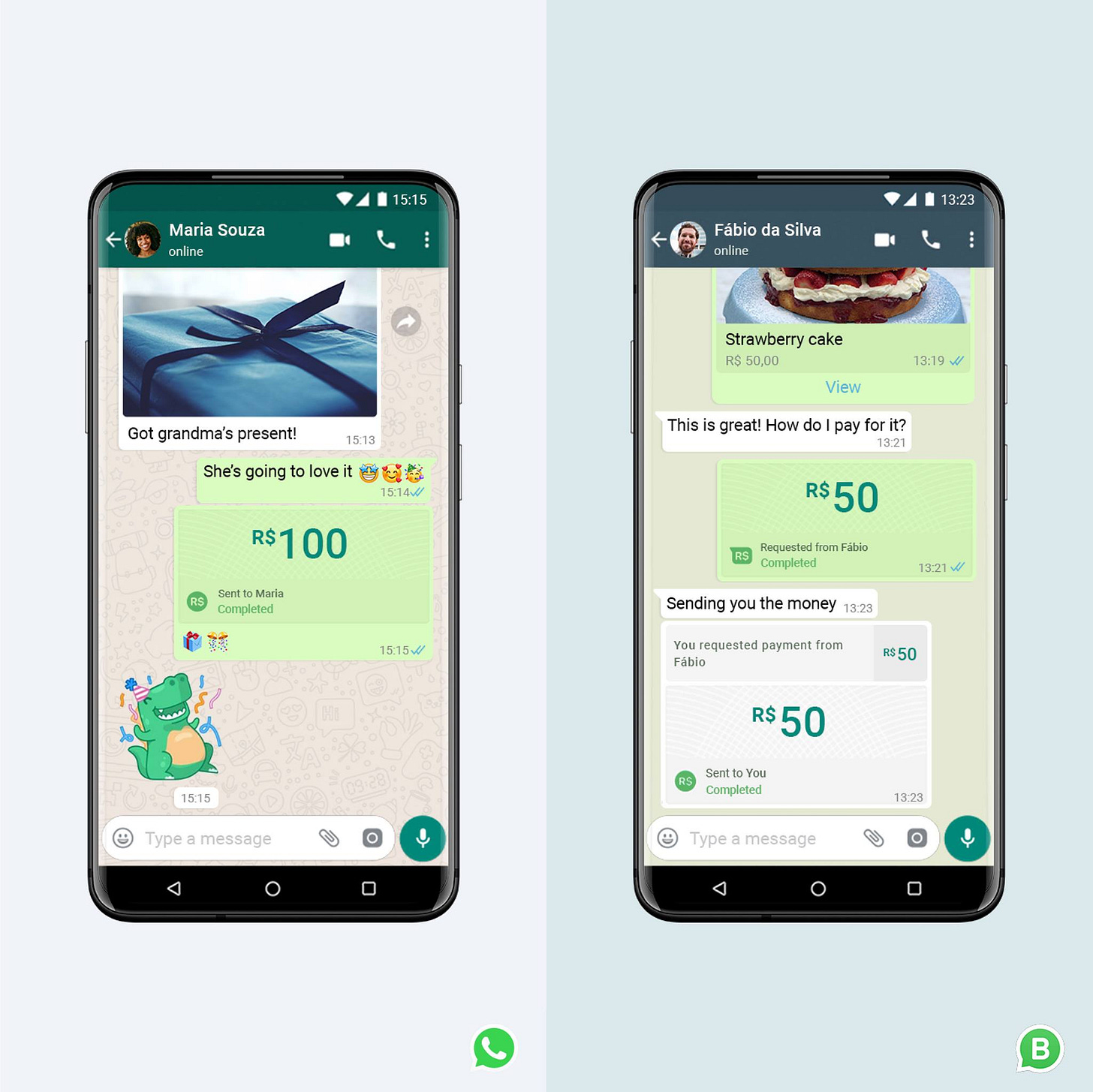

In Brazil, Facebook has enabled P2P transactions, using, as Mark says, “building on Facebook Pay, which provides a secure and consistent way to make payments across our apps”.

They’re also allowing individuals to make payments within WhatsApp chat with small businesses’ WhatsApp business accounts (photo on the right below)

In WhatsApp dominated markets like India and Brazil, there are standalone businesses building their companies on-top of WhatsApp. Some examples include:

Yalochat which helps brands better connect with their users by building CRM, marketing, customer service, sales, and conversation tools on top of popular messaging apps (namely, WhatsApp). They’ve raised $23M from VCs like Sierra Ventures and B Capital Group and currently operate in LatAm, India, and are expanding into Southeast Asia (all WhatsApp-heavy markets)

Digi-Prex provides patients with one-stop online ordering using WhatsApp and also a reminder system for their monthly supply of medication. They recently went through the new Southeast Asia accelerator, Iterative.vc

Vahan.ai is a WhatsApp chatbot for the recruitment and training of blue-collar workers. They raised a seed round in 2019 from YC, Founders Fund, Khosla Ventures, and others.

ChatPay is a Brazil-based company that enables people to monetize their WhatsApp and Telegram groups. They went through the YC Summer 2020 batch and raised a $2.1M seed round.

I highlight that each of these companies raised money from well-known venture capitalists to make the point that these are not just products. These are teams trying to build venture-scale companies largely on top of WhatsApp. Like companies in China who build companies leveraging WeChat distribution, entrepreneurs are now leveraging the ubiquity of WhatsApp to build businesses for their local countries.

As WhatsApp continues to build more payment features into WhatsApp, these businesses have the potential to get stronger. Though, at the same time, as WhatsApp builds more business-focused features into WhatsApp these companies run some risk of being cannibalized by native features.

The strong bull case for WhatsApp is that it looks a lot like WeChat. It started as a messaging app that gained ubiquity across big markets and is adding payments and commerce functionality on top of that.

The pessimistic case for WhatsApp is that they’re a part of Facebook and they may not be able to chart their own course as WeChat did.

Who is the product leader that is really calling the shots at WhatsApp now that both of the founders are gone? Although WeChat was started within Tencent, Allen Zhang is very much the founder of WeChat and is still a driving force on product development today. His identity is burned into the product. As WhatsApp needs to make critical SuperApp choices down the road, who is that coming from? Who is deciding the tradeoff between crowding the feed with advertisements vs. continue to push off monetization?

Facebook’s culture is not entirely friendly to third-parties and is heavily reliant on advertising. WeChat’s openness and ability to allow anyone to build on top of it is one of the keys to its success. Facebook will need to be okay with winning alongside other companies that specialize in functions like ridesharing, etc.

For example, I’m excited to see if WhatsApp allows a Gojek integration inside of WhatsApp where users can hail a Gojek from WhatsApp.

This adds additional arguments in favor of Facebook’s investment in Gojek.

One of the aspects that makes Super Appdom harder in the West, that Tencent used to its advantage in China, is the ability to invest in and acquire meaningful ownership stakes in the companies that you will support as Tier 1 partners within your Super App.

As we covered in WeChat Part 2:

Can you guess what’s in common about all of the companies powering [the featured services within WeChat]? In most cases, Tencent is one of the company’s largest shareholders.

Didi (Ride-Hailing) – Tencent owns ~20% of Didi.

JD.com (Specials) – Tencent owns ~17% of JD, a ~$100bn+ public company

Moguejie (Women’s Fashion) – Tencent owned 17.2% at the time of Mogu’s 2018 IPO

Zhuan Zhuan (Used Goods) – Tencent led a $200M round in 2017

Ke.com – (Housing) – Tencent led a $800M round in 2019

Pinduoduo (Buy Together) – Tencent owned 18.5% at the time of the IPO. Tencent first invested in PDD in February of 2017 and added them onto the WeChat Pay page in February 2018

For an aspiring Super App like Facebook or WhatsApp, these same opportunities were not available to them in the US.

Facebook likely did not have the opportunity to invest in a ride-hailing company like Uber or Lyft or an online marketplace like Wish. Also, given the maturity of the US market, some of the companies Facebook might have wanted to partner with (e.g., Netflix, Amazon, eBay) are older than Facebook, so the opportunity certainly was not available. But when you look at a country like Indonesia and think about Facebook’s Gojek investment in that light, it makes a lot of sense. It’s not too farfetched to imagine WhatsApp enabling users to call a Gojek through a WhatsApp mini-program-like feature. Keep an eye out for more investments from Facebook into markets like Indonesia.

Something I should have mentioned earlier… Here’s the list of countries with the highest number of internet users.

Since Facebook/WhatsApp has no real entry point into China, India and Brazil make a lot of sense.

Messenger

As far back as 2015, Messenger attempted to add Super App functionality. At the time, they partnered with Uber to make it possible for people to request an Uber directly from the Messenger app.

I just spent 10 minutes digging through all the settings and extra features in Messenger and I don’t think the feature still exists.

But it’s an idea of what Messenger as a Super App could look like.

As I alluded to earlier, Messenger is a bigger platform than I recognized. In January 2019, Facebook Messenger was still the top messaging app in 57 countries (e.g., US, Canada, Australia, Poland, Norway, some Northern African countries like Egypt, Nigeria, Libya, etc.)

Even though Facebook Messenger is still growing, it is losing its #1 position in many markets, in all cases to… WhatsApp.

If The Facebook Company wanted to take a bet on building a Super App for the US, it seems like Messenger would be the horse to bet on, though as an overall global strategy, WhatsApp seems to be the better investment.

I won’t write a ton more here because I think product-wise, Messenger would look a lot like what I laid out for WhatsApp, just catering to different markets.

Facebook.com

The media has not been shy about covering Mark Zuckerberg’s ambitions to turn Facebook.com into a WeChat-style Super App

And looking at the current Facebook.com mobile experience, it appears to mimic some of the Super App ideals – in terms of offering many experiences within one app.

Unlike Super Apps such as WeChat, every one of those features in the Facebook app is owned and operated by Facebook.

Facebook’s dating product is built by Facebook, not a partnership with Tinder.

Facebook “Videos on Watch” is built by Facebook, not a partnership with YouTube or Twitch.

And I think that’s the challenge for Facebook. While their in-house strategy has worked for them so far and turned them into the $700bn juggernaut that they are, it’s antithetical to building a Super App.

While writing this article, one of my favorite articles and one that made me feel most optimistic about Facebook’s potential as a SuperApp came from Bangladesh. The article covers Bangladesh’s “F-commerce” (“Facebook Commerce”) industry of individuals selling goods via Facebook Groups and Facebook Live streams.

An entire industry has been built up around these sellers. For example, “Paperfly is one of the bigger [logistics] players: it has already partnered with over 3,500 Facebook sellers and delivers to all 64 administrative districts of Bangladesh.”

In general, my worldview and view of successful companies tend to be more bottoms-up, than top-down. If I was on Facebook.com’s team, I would be laser-focused on markets like Bangladesh where “many consider “being on the internet” as simply having registered on Facebook.”

Instagram

For a Western-audience, I think understanding the case for Instagram as a SuperApp feels clearer.

Instagram built a popular, high-open rate application that is used by 1 billion+ people, with 130M users in the US. It’s also popular in India (100M), Brazil (91M), Indonesia (73M), and Russia (51M).

Besides its main function as a photo-sharing application, Instagram DM (it’s native message service) is also extremely popular, especially among younger generations that use it as a primary communication channel with friends.

The launch that really convinced me of Instagram’s full potential was seeing Instagram double down on in-app shopping.

Here’s an example of how Instagram could adopt some of the functionality that WeChat has and WhatsApp are building:

A friend of mine owns a boutique fashion store in New Jersey. Her store’s Instagram account has 14.8k Instagram followers and right now enables online ordering via Instagram DM.

By using Instagram’s new shopping tools, users would be able to purchase directly by clicking on a photo, adding it to their cart, and then checking out. An incredibly smooth flow. This also widens the market for brick and mortar businesses, which previously would have been limited to foot traffic, to global business from anyone who is interested in the type of clothing they sold. It changes some of the dynamics of my friend’s business where now just by posting beautiful photos, she can attract business from all over.

If Instagram added native QR code payments in their app, a user could go into my friend’s store and pay right from the Instagram app. That sounds a bit odd at first glance, but if the shoppers entire association with the store is through Instagram, it might not actually be that strange.

Now, I’m not a big Instagram user (I do have an account though), nor do I like shopping, so I’ve never actually used Instagram Shopping.

For the purpose of this article, I decided to play around with it a bit. Along the way, I became more skeptical of the product. First, it’s called “Facebook Shops”. I’m more optimistic about the future of Instagram if Facebook lets it maintain the ethos that made it successful in the first place.

When I went to a Tier 1 brand, the experience was excellent. Looking at this recent Zara photo, they tag all the things on the woman’s necklace and you can easily add to your cart and checkout.

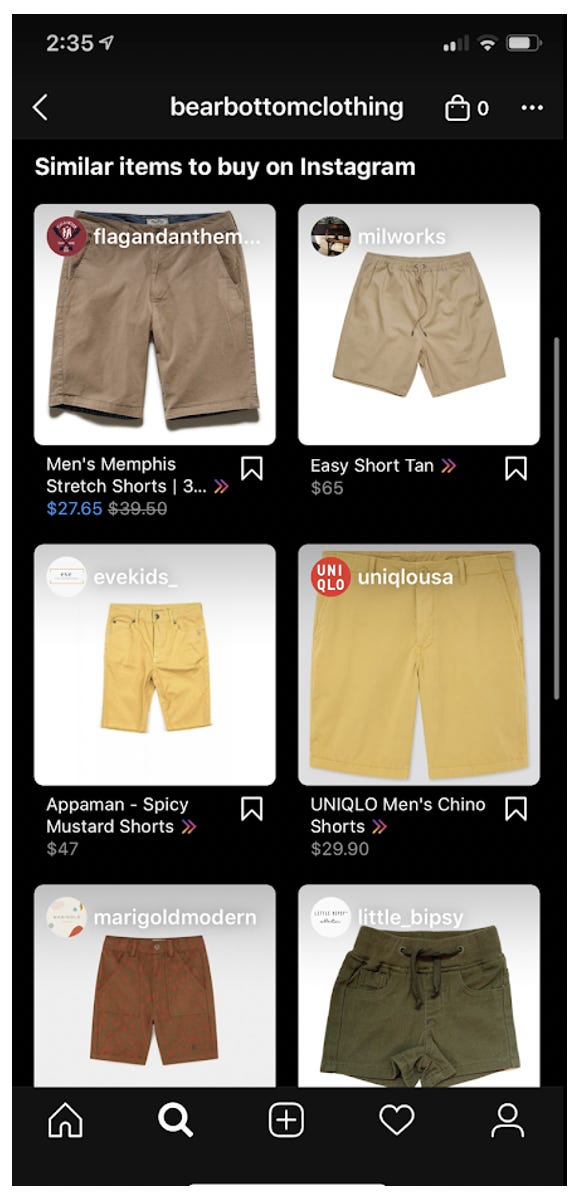

When I went to a brand that I actually shop with, Bearbottom Clothing, the experience was suboptimal.

I was not able to add their clothing items directly to the Instagram shopping cart. I was redirected to the Bearbottom website to do my payment and checkout there. It’s possible that this is Bearbottom’s fault and they have not set up the right account yet.

The worst part though, from the brand perspective is that underneath the pair of shorts I clicked on was “similar items” from other retailers. If I’m a brand trying to sell on Instagram, the last thing I want to see if knock-off or competing products advertised beneath my own.

And this is one of the reasons to be bearish on Facebook-owned products chances at becoming Super Apps. Facebook has an engrained culture and product ethos around advertising that could be antithetical to other apps living on top of their platforms.

But for Instagram specifically, given how beautiful the feed can be, it seems like a prime app to e.g., connect to Uber Eats and easily allow you to order something from a photo.

Closing Thoughts

One other framing I thought of to describe Super Apps is that they’re basically like a government collecting sales tax. Say Tencent takes a 10% cut of Didi rides hailed through WeChat. Didi won ride-hailing in China, in part because of the Tencent investment/WeChat native integration (support from the “government” in my analogy) so paying the Super App tax is worth it. It’s a bit like trading profit margin for distribution. Thoughts?

I spent a lot of time focused on WhatsApp because I believe it’s the app most primed to become a Super App, but given Facebook’s resources, all of its properties have the ability to make the transition.

My critique throughout has been that I believe that some of Facebook’s cultural ethos is opposed to what has made other Super Apps successful (namely, eschewing advertising and deep integrations with third-parties).

Going forward I think this “Aspiring Super App” series will be a bit more sporadic. In my next issue, I plan (though plans could change) to go back to writing about companies, in the vein of my Gojek, Grab, WeChat issues. I’ll sprinkle in “Aspiring Super App” issues over time.

If you feel compelled, I would be very grateful if you Tweet this article out, share it with friends, or link out to it wherever people might enjoy it.

Thanks for reading ❤️

Until next time friends!